Helping My 50 Year Old Mom Select Life Insurance.

How Our Search Began:

A couple of weeks ago, my mother, Indra, turned 50. I remember when we celebrated, she emphasized this age as a fresh start in her life with extra responsibilities. Underneath the happiness of turning a new age, my mother was also concerned as she knew she was only getting older and my brother and I were still her responsibility. The age of 50 motivated her to do only one thing: search for Life Insurance.

Our Journey Begins:

My family, especially my mom, is new to Life Insurance. We never once looked into it. Once we did we had no clue that there were various coverage plans and were clueless on where to start. But until recently, she decided it was time to secure extra protection, for her family, my brother, and me. Researching Life Insurance was a tough start, but we took baby steps until we actually understood the industry and its products to our own standard. The variety of plans and companies was endless, so it was so hard to decide on which one to select. Between Term and Whole Life, my mom selected Term Life as we found it was more suitable for our circumstances. She wanted immediate stability and coverage, something that was cheap and allowed for flexibility and so we decided Term Life was best.

Nationwide:

We began with Nationwide. I implemented her statistics into the Term LIfe Insurance resulting in the coverage amount for X amount of years. For example, for a 10-year coverage and a $150,000 coverage amount, my mother would have to pay $29.53 a month to support and fulfill that $150,000 coverage.

That, for us, was immediately an option. It was affordable and did not limit her with time as she was able to figure out the next couple of years of her life while also being covered. However, we did not want to place all of our eggs into one basket without fully exploring.

AllState:

We went onto AllState where we also got a quote on the cost/coverage of the insurance. When we did the actual quote, it turned out Nationwide offered more of what we wanted. Allstate offered a $250,000 coverage which was not something was wanted. We aimed for a lower coverage rate than that. As a newcomer to the Life Insurance world, my mother wanted something simple, understandable, and convenient.

State Farm:

In addition to wanting a smaller coverage, my mom figured that with Nationwide there would be more flexibility in terms of time and money since she was not concrete on how long she wanted Term Life for. I also researched and input my mother's statistics into a State Farm quotation calculator. They did not have an option for exactly $150,000 coverage but instead $100,000 and so we selected that. As a result, we would have to pay $35.06 monthly to support a $100,000 coverage. In comparison, Nationwide works out cheaper as we would get more coverage for the same amount of years while paying a slightly cheaper amount per month.

Transamerica:

As for Transamerica, when I put her information into the quotation predictor, it gave my mom a monthly cost of $21.50. This was cheaper than the Nationwide cost in terms of monthly payments. However, we then realized that we inputted two different coverage amounts into the quotations. In the Transamerica quotation calculator, we put $100,000 as my mother’s coverage amount. In the Nationwide quote producer, we inputted $150,000. So I decided to make sure I am not cutting her short of benefits, to put the pricing to an accurate test. When placing $150,000 as a coverage amount in Transamerica, I got $30.96 as a monthly cost. Therefore, what we realized was that Nationwide was cheaper.

Quotacy:

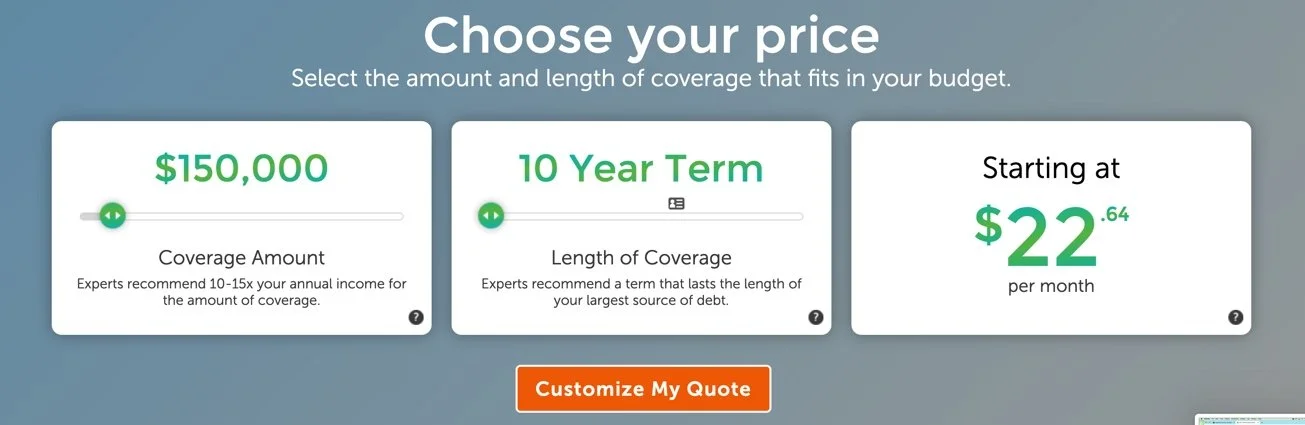

My mom was speaking to her friends about coming to this decision in order to ask for some helpful tips and advice. One of her friends advised her to check out Outacy to get “accurate. Turns out, Quotacy is a lot cheaper for the same $150,000 coverage amount and for a time period of 10 years. However, my mom had already set her mom about Nationwide given that it had a well-known reputation and there were more people who have it.

Haven Life:

When we first research Haven Life, it was well known for its’s life insurance and so we decided to get a free quote. We immediately knew it was not for my mother as the minimum coverage amount was $250,000. As I mentioned, my mother’s range was $100,000 - $150,000. But to see what the monthly cost would be we selected $250,000 coverage amount with the same information about her health and time coverage we got that she would have to pay between $31.57 to $58.49 a month.

The Result:

Because of the investment and commitment, my mother saw that for her the most viable choice was Nationwide. She was paying less money for the amount of coverage she wanted for only 10 years. In fact, she never. wanted to make a long-term commitment to the first life insurance she had as she would like to see how it worked out for her and she was given time to explore her next step.

Start Your Search:

For people who have families, it is especially essential to recognize that life insurance is only to protect you and your family in case of an injury or death. Specifically, Term Life leaves room for flexibility while still prioritizing your safety and family’s protection. At InsuredTY, we do the same, especially for the underrepresented women in the US.