Lifetime Value/Customer Acquisition Costs

What are LTV and CAC? Why Does it Matter?

LTV stands for “lifetime value” and is the average revenue a single customer is predicted to generate over the duration of their account. CAC stands for “customer acquisition cost” and is the expense incurred in the process of convincing the customer to purchase the product. The ratio of LTV/CAC helps a company determine how much it should be spending to acquire a new customer. The value generated can be used to see if spending costs are too high per customer or if opportunities are being missed by not spending enough to acquire customers. If LTV/CAC is below 1.0, the company is destroying value whereas if the ratio is above 1.0, the company is creating value. Despite this, having an LTV/CAC ratio over 1.0 does not necessarily mean a company is profitable as the ratio only takes into account marketing expenses. To determine real profitability, more analysis is required.

Gauges the cost-efficiency of sales & marketing strategies

Determines the long term feasibility of customer acquisition strategies

Customer acquisition costs vary with time and are not constant

Churn rates also change with time

Different CACs by Industry (Average)

Customer Acquisition Costs vary from industry to industry. It is less expensive for companies focusing on consumer goods to acquire customers than it is for a company selling financial services. Below are some average CACs for various industries:

Software - $395

Telecom - $315

Banking/Insurance - $303

Real Estate - $213

Hardware - $182

Financial - $175

Marketing Agencies - $141

Transportation - $98

Manufacturing - $83

Consumer Goods - $22

Retail - $10

Travel - $7

LTV/CAC for the Life Insurance Industry

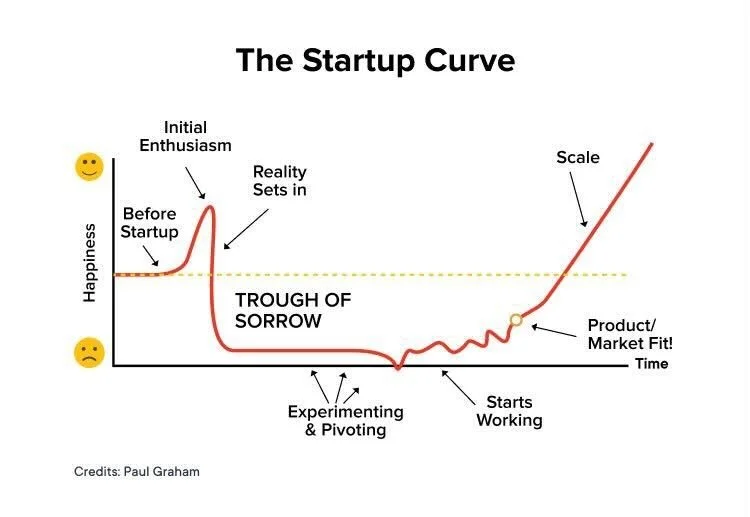

Customer acquisition costs for the life insurance and financial services industry are fairly high. This is mainly due to the products/services that are being provided by those companies being one-time purchases and/or long-term usage. A variety of sources indicate that the insurance industry has a CAC of between $300 and $700 per customer. This high price of acquisition must mean that a high LTV would follow, which typically it does. However, conversion rates from potential leads to actual customers are quite low. InsuredTY hopes that it can convert every 1 out of 100 leads into an actual customer just to break even. Finding product market fit is key. Typically, startup companies face some trouble acquiring and retaining customers until their ideal market is tapped into.

InsuredTY CAC Metrics/Strategy

Strategy 1: “Northwestern Mutual hires interns to cold call/cold email family and friends”

InsuredTY’s preliminary strategy in acquiring customers was to leverage the networks of the various interns working for InsuredTY. On their first shift, interns would create a leads list of all potential contacts in their network and parents of friends that are suitable for the term life product. After listing about 20 to 30 leads, the intern would then proceed to send out a cold email to the contacts listed. The intern would then repeat this process until they have exhausted their network and have no more potential leads. The email contains basic information about Tim Yang and what InsuredTY has to offer. At the bottom, recipients can potentially schedule a call with Tim to further explore the insuring products that are being sold.

Costs to send out these cold emails are very low as the only cost incurred is InsuredTY paying their interns an hourly rate. However, conversion rates from these cold emails are also significantly low, proving this strategy to be ineffective for the time being.

Strategy 2: Zoom Workshop Strategy - once an intern runs out of leads, give friends $40 for 30 minutes on Zoom to watch a youtube video and email 10 parents

The Zoom workshop is a somewhat new strategy that InsuredTY is experimenting with. Once the interns at InsuredTY exhaust their leads list, they send out a flyer to friends and family via text message/email about chatting with Tim. They are offered $40 for 30 minutes of their time in exchange for feedback and access to their networks. If a recipient is interested in this workshop, they schedule a time with Tim to chat on Zoom. Tim then plays those who have signed up a YouTube video on investing+insuring and gathers feedback on the video and ways to improve it. In addition to that, the participants are asked about what the best methods would be to reach parents regarding Nationwide term life insurance. Lastly, the participants are asked to send a cold email or text message out to 10 parents in their network that may be interested in the product or help to spread the word on it.

Costs to hold these Zoom workshops are fairly low. The costs incurred to gather feedback and new leads are only $40 per person that signs up for the workshop. As this strategy is new, conversion rates have yet to be tested accurately. More time exploring this workshop strategy can prove to be beneficial as leads from various networks are acquired.

Strategy 3: Create Online Advertisements: PPC, Facebook, LinkedIn, Nextdoor, Google

Digital advertising is another strategy that InsuredTY has been using for a while. Primarily, advertisements on Facebook and Google are used at the moment with various other websites at a lower frequency. Currently, spending is approximately 3$ per click and one email for an estimate/inquiry is sent every ~10 clicks.

Costs to run these digital advertisements are fairly high given the low conversion rate. Currently, InsuredTY spends about $200/day for online advertising which translates to about $6,000 every month.

Strategy 4: Hire Popular Moms

Hiring a popular mom is a strategy not yet experimented but will be in the near future. The goal is to find a popular mom in the local area of Montgomery County, Maryland and hire her to market for InsuredTY. Paying a high hourly rate with a low hour commitment per week is what will be attractive to this candidate demographic. This mom will leverage her network of ideal aged candidates for term life insurance and the hope is that a few potential leads are converted into customers.

Strategy 5: Sponsor parties/Community Non-Profits

Another strategy yet to be tested are InsuredTY sponsored parties and community events. InsuredTY would pay a fairly high sponsorship fee for a party or community group (e.g High School PTA , Churches) and in return have their logo and information given to all attendees/members. Targeting high schools would be beneficial as the parents of the students would be ideal aged potential customers for the products being sold.

Raising Capital to Scale

Raising capital is no walk in the park. Many startups fail to achieve profitability and end up going under within the first few years of starting their business. Acquiring the necessary funds to run business operations typically comes out of the business owner’s pocket to begin. As time goes on, many startups who have seen some success go on to apply for funding. This funding typically starts as pre-seed then moves onto the seed rounds if the investor(s) see that business is going well. For a company like InsuredTY that is focused on delivering insurance products through Nationwide and Pacific Life, investor funding is not really an option. All expenses must be paid by founder Tim Yang in order to stay afloat.

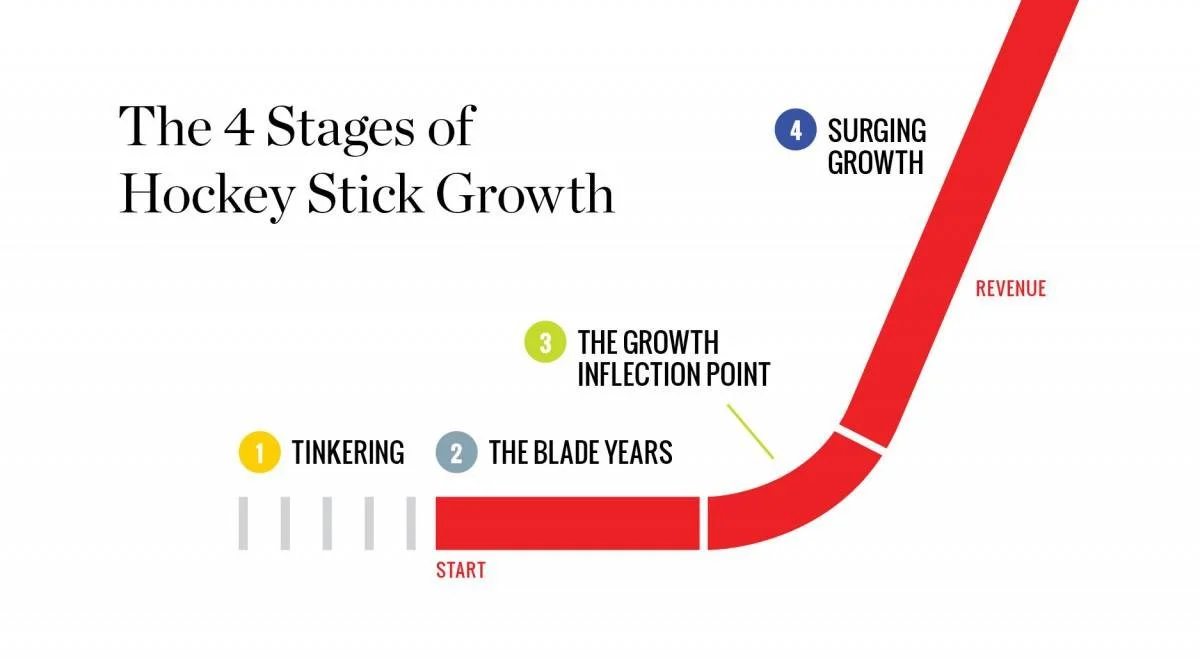

With that being said, finding product-market fit e.g “the hockey stick,” is crucial for InsuredTY to grow and become profitable. Product-market fit is the degree to which a product satisfies market demand. It has been identified as the first step to creating a successful venture in which the company meets early investors, gathers feedback, and gauges interest in its product. Why is that important? Businesses must know if their products have a market appeal before spending thousands of dollars creating advertising campaigns, hiring employees, and incurring various other expenses trying to rapidly expand their business.

Hockey Stick Growth is a common method of representation that displays the stages of growth many startups go through. It starts with the tinkering phase, usually when a business owner is still at his/her day job, examining their idea more seriously and if it’s the right way to enter their selected market. Next are the blade years, which InsuredTY is currently in. These are the 3-4 years that follow the tinkering phase in which the founder of the company dedicates their full capacity to their selected venture. They are called the blade years because this phase represents the blade of the hockey stick. Revenue at this point is extremely low if any. After that, comes the growth inflection point of business. At this stage, the business model is nearly perfected and revenues begin to turn up. Scaling the business up becomes the number one priority at this point. Lastly, comes surging growth. The last stage of the hockey stick model features accelerated growth as the business is to scale and is producing higher revenues with more recognized profits.