"Term vs Whole Vs Universal Life? How to Decide!"

When it comes to life insurance, it can be overwhelming especially for people who have just begun investing in it and learning about life insurance. Specifically, when people hear about Term Life, Whole Life, and Universal Life it is difficult to decide on which route to take when the differences and similarities are unknown and there is uncertainty in which insurance is the best fit. To make up for this, this article will break down and share other articles to inform you about Term, Whole, and Universal Life insurance so you are able to seamlessly navigate this journey.

Term vs. Whole Life

Article 1: “Term vs. Whole Life Insurance: Differences, Pros, and Cons”

https://www.nerdwallet.com/article/insurance/term-vs-whole-life-insurance

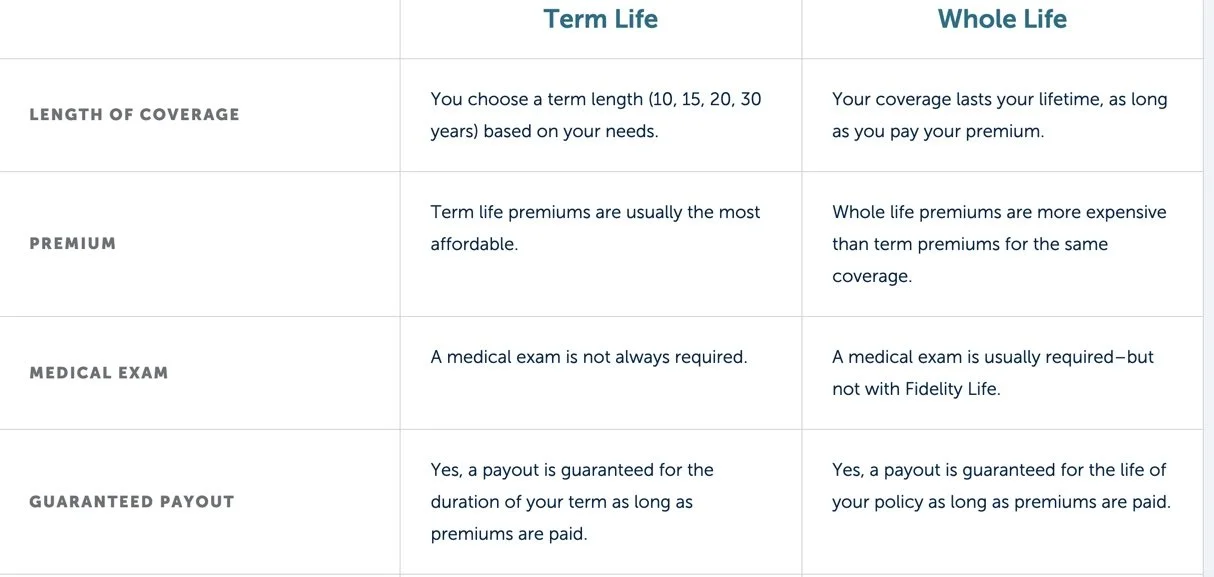

The article above simplifies the definition, the pros, and the cons of Term vs. Whole Life. It begins with a basic rundown of what each life insurance is. For instance, it states “The way term life insurance works is simple: it covers you for a fixed period of time, such as 10 or 20 years, and pays out if you die during the term..” As for Whole Life, “ it is the most common type of permanent life insurance and costs more than term life. This is because it offers lifelong coverage and pays out regardless of when you die.” Towards the middle of the page, there is a comparison chart displaying the cost and the features offered by each. What is most important and helpful about this site, is the listed bullet points at the end of the page stating reasons one should get Whole Life vs. Term Life ultimately gives insight into the most suitable one.

Article 2: “Term vs. whole life insurance: Which is right for you”

https://www.guardianlife.com/life-insurance/term-vs-whole

The Guardian Life made a publication speaking about the attributes that come with each insurance and the reasons a person should select Term Life or Whole Life. Similarly, to the previous article, the features of each insurance are stated as well as the pros and cons. For example, one of the listed pros of Term Life is that it is affordable and the initial fee is not costly. If you would like to see and understand life insurance more, the article does a great job of explaining it. The precision of this article and the decision-making process is really elaborate in the sense it properly guides you to under your own circumstances, if you need life insurance and, if so, which one. The article also targets attributes such as the price and duration of the coverage.

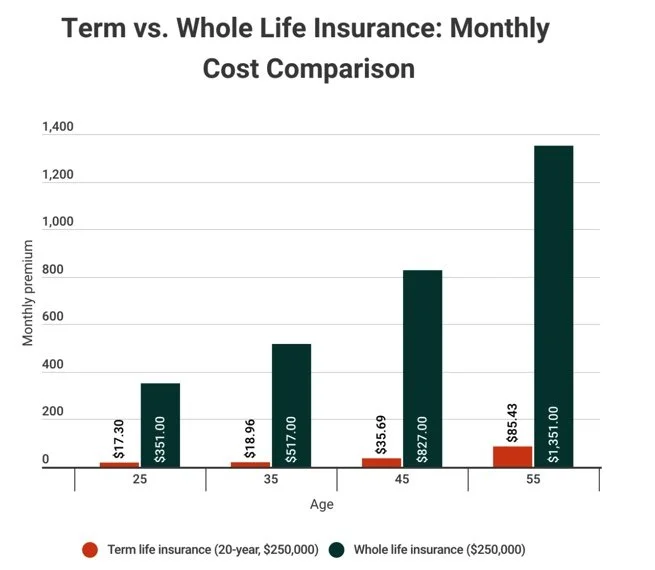

Below the chart compares the two life insurance. From this, you can see that the Term Life cost of the premium, initially, beings at a low rate but with Whole Life, the premium figure is usually on the higher side.

Article 3:” TERM LIFE VS WHOLE LIFE”

https://fidelitylife.com/learn-and-plan/learning-center/types-of-life-insurance/term-life-vs-whole-life/

If you are looking for an article that quickly describes Term vs. Whole Life, this is the one for you. From quickly listing key takeaways from life insurance to directly saying the difference between the two, Fidelity Life gets straight to the point about Term vs. Whole Life. The breakdown of both of the life insurance is efficient and really understandable to an extent where you do not have to do further research. The article, itself, uses questions such as “Are you on a budget?” and “How long do you need coverage?” to depict and help consumers like yourself analyze what is the necessary vs. unnecessary for you when it comes to life insurance.

As a common factor with these articles, It can be said that Term Life simply is cheaper than Whole Life. The catch is Term only covers someone for a period of time whereas the Whole covers someone for their entire life. Whole Life also has cashback value and increases over time.

Article 4: “Comparing Term Life vs. Whole Life Insurance”

https://www.forbes.com/advisor/life-insurance/comparing-term-life-vs-whole-life-insurance/

Like the other articles, Forbes distinguishes the difference between Term Life and Whole Life. In addition to the pros and cons of each, Frobers manages to go more in-depth of what each offers and describes the features/attributes that come along with each. Specifically, they speak deeply about premiums, payouts and cash values which were before but in a broad sense. For someone who is willing to get more involved in knowing what each has to offer, this website is a good way to start that journey of exploration.

Article 5: “Term life insurance vs. whole life insurance: Which is right for you?”

https://www.statefarm.com/simple-insights/life-insurance/term-or-whole-life-insurance-which-is-right-for-you

State Farm also does a great job of writing in a concise yet informative way. If you are just getting started in understanding life insurance and want to get the basics down, this is a great way to start. It begins by giving the definition of Term Life and Whole Life and then continues to describe its benefits. Now when the article begins to describe the benefits, that's where you will find the golden tickets as it reveals to you the benefits that each type of insurance offers to you. Unlike the other articles, this one lists the benefits in a descriptive manner so that you can compare not only the two insurance to another by comparing them to your own conditions.

Article 6: “Life Insurance, Whole vs. Term: Which is Better?”

https://www.annuityexpertadvice.com/life-insurance-whole-vs-term/

The article above elaborates further on the pros and cons, the price of the insurance, and on what conditions you should purchase either Term or Whole Life insurance. What is really important and different from the other articles, is this one, in particular, gives a list of key advantages and disadvantages you may face depending on which type of insurance. If you are looking to explore your benefits/advantages this article would be especially helpful.

Article 7: Term vs. whole life insurance: How to make the right choice

https://www.policygenius.com/life-insurance/learn/whole-life-versus-term-life-insurance/

As a basic rundown, Term Life only coves someone for a certain amount of time whereas whole life covers them for their entire life. Now, Term Life is often used as an alternative for Whole LIfe because of how expensive it can be. The monthly payment for Term Life increased by a little amount depending on the person's age however if you look at Whole Life, the monthly payment skyrockets to become a huge expense.

Term vs. Universal Life

Article 1: Term vs. Universal Life Insurance: What's the Difference?

https://www.investopedia.com/ask/answers/205.asp

In a nutshell, the difference between Term and Universal life is the length of the policies offered, how much they cost and if they have the attribute of cash value. According to this article, Term Life is “Term life is the most basic type of life insurance policy, and it simply provides coverage for a specific period of time.” On the other hand, Universal Life is “Universal life insurance falls into the broader category of policies referred to as permanent or cash value insurance. These types of insurance policies combine a death benefit (like a term policy) with a savings component or cash value that builds up over time on a tax-deferred basis.”

Article 2: What is Universal Life Insurance? Pros and Cons

https://www.valuepenguin.com/life-insurance/universal-life-insurance

Universal Life. What is it: A form of permanent insurance and can last for a lifetime only if all premiums are paid.

Cash Value Attribute: Universal life insurance has a cash value attribute that is separate from the death benefit. When a premium payment is made, a portion of that payment is put towards the insurance and the rest is the cash value. Depending on the minimum APR at the time, cash value have the tendency to increase based on market performace.

Maturity Date in Universal Life Insurance: Universal Life insurances also have a maturity date which means when you turn to a certain age and you receive your payment, the policy will end. As payment, you can receive the death benefit or a certain amount of money that is the equivalence of your policy cash value.

Article 3: What Is Universal Life Insurance: A Complete Guide

https://time.com/nextadvisor/insurance/life/universal-insurance/

From the articles, the main facet of this insurance is to pay a monthly premium fee and have a cash value build up. Once it has been increased, you can borrow or withdraw from it.

These are some of the qualifications you need to have to be viable for Universal Insurance:

Poor physical health: Insurance companies may decline to provide coverage for individuals with serious health conditions.

Age: Most insurance companies will only provide life insurance coverage for individuals under a certain age.

Lifestyle: Insurance companies may be more likely to deny coverage to individuals with high-risk hobbies, a high-risk job, or unhealthy habits.

Credit: Insurance companies might run credit checks before underwriting insurance policies. If you have poor credit or a poor financial history, you might struggle to qualify for some types of policies.

Criminal record: You may be denied life insurance coverage if you have a criminal record, especially if you have felonies on your record.

My Recommendation:

As someone who has just begun learning about life insurance, I can definitely understand how overwhelming it can be. From Term Life to Whole Life to Universal Life, they all have the same goal but it really depends on the conditions of the person investing. For me, I do not have a full financial standing for Whole or Term Life yet, so I would select Term LIfe as it still covers me for at least 10-30 year and is more in my price range. However, if you are in a position where you have the ability to cover monthly premiums and pay the increasing Whole Life Insurance, it can definitely be for you. From what I have seen, I would still look at each life insurance and examine the effects of taking each one. For example, if you are looking into taking Term Life, what is the guarantee that you will get your money back? Can there be any scenarios where your beneficiaries do not receive money? Is there an APR attached to Term Life? I would look into questions like those to cover almost every corner and really make sure I am not jeopardizing anything.