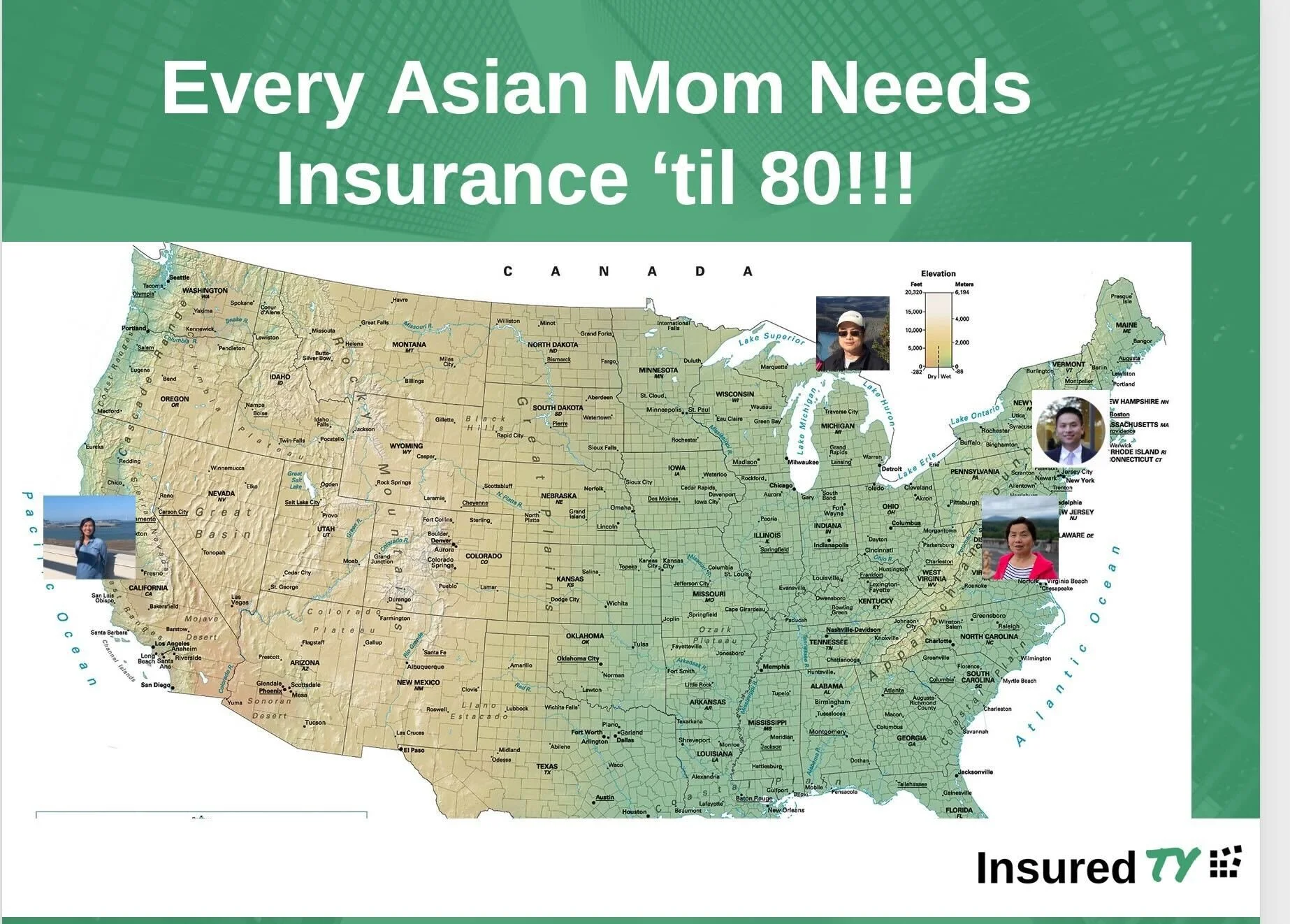

Why Every Asian Mom Needs Life Insurance

Immediate family is scattered across the globe –

Immigrant families have the tendency to follow a trend where the immediate family is not within immediate reach. This increases the risk of financial instability and poses a threat to all Asian parents, specifically Asian moms. With their children spread throughout the United States and even abroad, finances must be maintained, but even further than that, protected. That’s where we come in with term life insurance. If you’re an Asian mom between the ages of 35 and 60, have saved up wealth, and have not considered securing your funds through an insurance institution, the time is now. In the case of an unforeseen, catastrophic accident, having a life insurance policy can provide your next of kin with a large sum of money from just a fraction of how much you put into the policy. Take for example a 35-year-old mother in great health living in Maryland. For a 20-year, $1,000,000 policy, monthly payments would come out to just under $40 a month.

Women complete most of the unpaid labor and need a stronger safety net –

Another huge factor that should be accounted for when determining if life insurance is needed is the generational issue of how women are often compensated less than their male counterparts. This is in part due to labor market inequality and fewer job connections. Some time will pass before women on average, make nearly as much as men. In addition to that, women tend to have more frequent gaps in employment due to childbearing, childcare or caring for elderly parents or relatives. Therefore, women generally receive less monthly Social Security benefits based on their own earnings histories, as compared to men. Due to this occurrence, a stronger safety net is mandatory for all moms, especially immigrant moms. A lot of time will go by where women are doing unpaid labor and other tasks that hinder their stable flow of income. Purchasing a term life insurance plan, protecting finances, and securing money for your children's futures is as little as $40 a month. Don’t wait, monthly premiums skyrocket after the age of 55!

Health and social differences between genders -

On average, women live much longer than men in every country around the globe. In the United States specifically, women tend to live a whole five years longer than men. This creates an increased risk of financial insecurity for older women who are retired and not making a steady stream of income. All women must protect their futures as well as their children’s. If protection for a fair price is what is needed, term life insurance is the answer! Just $35+ per month for $1,000,000 coverage until 2042!