Why My Immigrant Parents Purchased Whole Life Insurance

Buyer’s Journey

Stage 1 - Awareness:

Ever since my father immigrated to the United States from India, his main underlying goal was to provide financial stability for his family and loved ones. Back in the 1980s, interest rates on simple savings accounts were around 8% whereas the S&P 500 index was growing steadily between 10% and 30% year after year. As my father was not a strong advocate in placing funds into the stock market, he relied on the simple interest his bank accounts were providing and grew his wealth slowly but steadily. When my sister was born in 1999, my father was already 43 years old and had a solid amount of savings put away. Realizing that as an older father, he wouldn’t be present in the lives of his children for as long as he wanted to be. Therefore, the concern he had was being able to provide for his kids even after he was out of the picture. That is where his search for life insurance came to fruition. He wanted to leave his family with a legacy and proper funding rather than swamping them with bills and depleting their savings.

Stage 2 - Consideration:

Shopping for life insurance is no simple task. With dozens of companies and different coverage plans, building trust with a life insurance agent was my dad’s main concern as his mindset was that the majority are just trying to make a quick commission from him. After a few years of searching with no luck, my mother’s younger brother had recently become an agent with New York Life. Although my father was still hesitant, he got to sit down and talk about the various plans and monthly premiums that New York Life had to offer with my uncle. After a year of consideration, my mother and father had decided on what plan to purchase that best fit their needs. However, my mother was expecting another child, me, and that delayed their purchase until 2001.

Stage 3 - Decision:

After I was born, my parents both purchased universal life insurance from New York Life. My father’s coverage plan was for $500,000 while my mothers’ was for $1,000,000. Monthly premiums were a significant amount of money as the $500,000 plan required $550 monthly payments whereas the $1,000,000 plan required over $1,000 a month. My parents chose universal life insurance because of their age, financial status, and benefits. Whole life insurance as the name suggests, lasts the entirety of one’s life versus term life which is typically a 10, 20, or 30-year coverage plan. As my parents had the means and assets to purchase whole life coverage at 10-15x the price of term life, they did as such and reaped the benefits of their money growing tax-free.

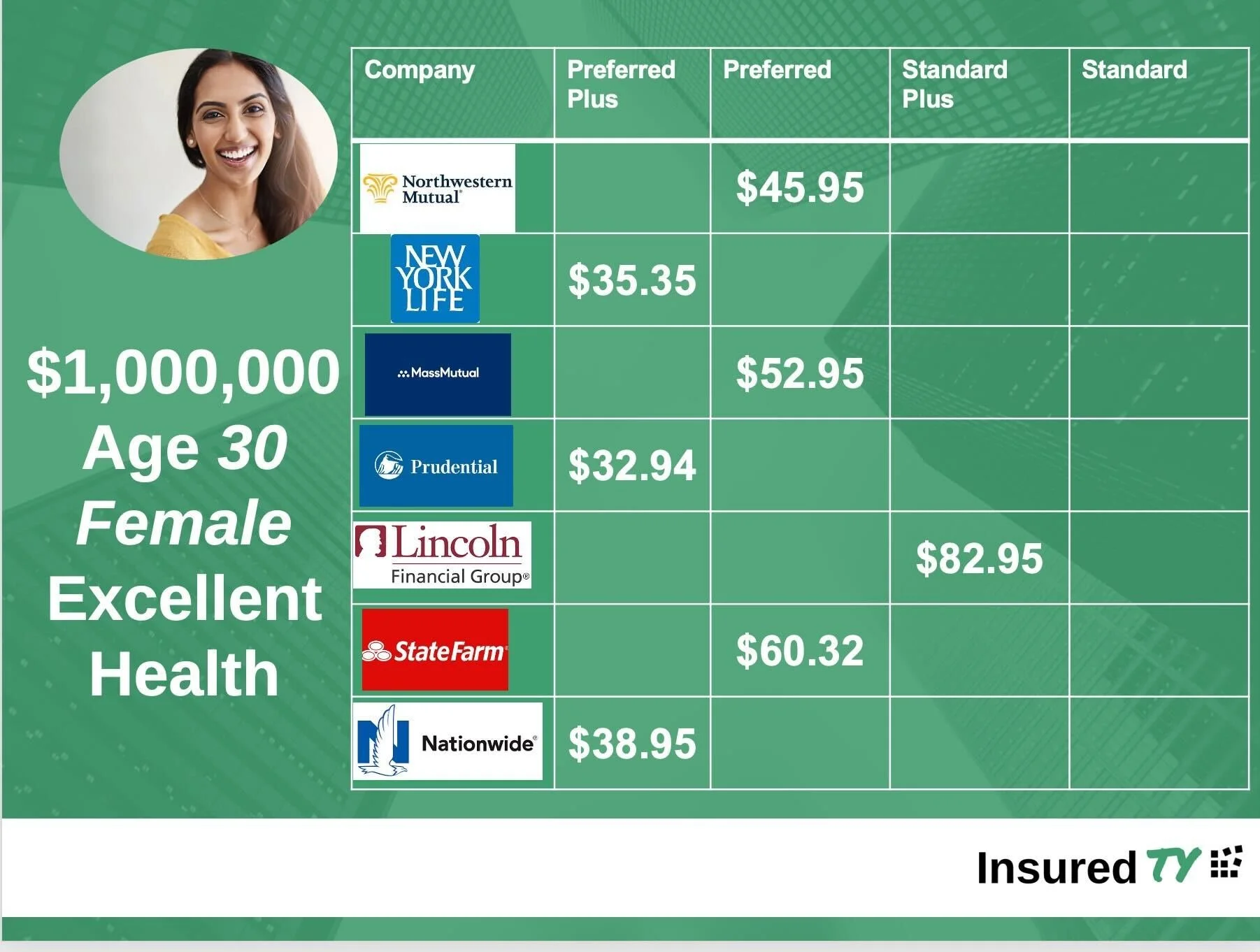

What InsuredTY Recommends:

Here at InsuredTY, we promote purchasing term life insurance by the age of 45. A 20-year, $1,000,000 coverage plan would only cost $35+, depending on the age at which you start your policy. The benefits of term life are substantial and at the fraction of the cost of universal life! For one, term life is 10 to 15x less expensive than universal life coverage and can be easily terminated if necessary. In addition to that, the plan only lasts up to 30 years and can be converted into a whole life plan further down the road. After hitting the age of 50 and considering estate plans, a transition to whole life coverage can be done quite easily! We recommend term life while young and building wealth.